National Center for Policy Analysis (NCPA)

Obamacare Health Insurance COOPs Are Unraveling

No. 163

Thursday, June 04, 2015

by Devon M. Herrick

Many supporters of the Patient Protection and Affordable Care Act (ACA) wanted a public plan option to compete with the private insurers offering insurance in the state and federal health exchanges. To placate these progressives, the ACA created a type of nonprofit health insurance cooperative that would borrow funds from the government for start-up costs and solvency reserves.

However, the Consumer Operated and Oriented Plans, or health insurance COOPs, as they are commonly known, are slipping into insolvency. All but one lost money in 2014 and one failed spectacularly — singularly forcing about 20 percent of all COOP enrollees to shop for another plan. Worse yet, many COOPs appear to be setting artificially low premiums to gain market share, in the process losing money taxpayers are expected to cover. The latest failure was Iowa-based insurer CoOportunity Health.

What Are Health Insurance Cooperatives? CoOportunity Health was not a traditional health insurer. Rather, the organization was a taxpayer-funded, nonprofit health insurance cooperative established under the ACA.1 COOPs were a political compromise during the health care debate, primarily serving as an alternative to the public plan option many progressives wanted.2

Advocates hoped COOPs would function like nonprofit, enrollee-owned mutual insurance companies that would do what for-profit insurers supposedly refused to do — put the needs of people ahead of profits.3 These member-led plans would provide all the latest patient-centered benefits — despite little evidence these measures are cost-effective. Proponents hoped COOPs would outperform established, for-profit insurers and undercut their premiums. In retrospect, this idea proved naïve.

COOPsf Fundamental Flaws. The COOP program is plagued by numerous flaws. When COOPs were established, they had no customers and no historical actuarial data to assist in setting plan premiums. Startup funds and cash reserves were borrowed from the government, with funds allocated by the ACA. In any other industry the members of an operating cooperative are the owners of the entity and provide its capital. Yet, this model does not easily apply to health insurance cooperatives. The customers of a health insurer are unlikely to spend, say, an additional $1,000 each to fulfill capital requirements. Thus, it stands to reason the cooperative business model is ill-suited to an industry requiring vast amounts of capital mandated by insurance regulations.4

Making matters worse, COOP proponentsf political agenda overshadowed economic considerations — dooming what little chance of survival COOPs ever had.5 For instance, advocates of public health coverage have long complained that insurance company profits and marketing waste money and drive up premiums. As a result, COOPs were barred from using federal startup funds to advertise and market their plans. But without access to equity markets and advertising dollars, COOPs were doomed to failure. The Office of Inspector General also feared the member-owned aspect of COOPs would result in low premiums at the expense of financial viability.

Critics on the Left and the Right. The fact that COOPs had no competitive advantage seemed to matter little to those supporting the idea. Yet there were many critics — even among Democrats. Nobel Laureate Paul Krugman said, gAnd letfs be clear: the supposed alternative, nonprofit co-ops, is a sham. Thatfs not just my opinion; itfs what the market saysch He continued, gClearly, investors believe co-ops offer little real competition to private insurers.h6 Senator Jay Rockefeller (D-W. Va.) expressed the same sentiment, referring to COOPs as a gcdying business model for insurance,h arguing gcthere has been no significant research into consumer co-ops as a model for the broad expansion of health insurance. What we do know, however, is that this model was tried in the early part of the 20th century and largely failed.h7

Prospects Going from Bad to Worse. About 500,000 individuals were enrolled in a health insurance cooperative plan at the beginning of the fourth quarter in 2014, according to industry data.8 The COOPsf first-year performance was dismal for many reasons. Membersf first-year claims were exceptionally high, which also hurt the COOPsf chances for success. They also had to recruit managers, hire employees, establish protocols and perform outreach to enroll members despite an exchange system that was working poorly. Many of these individuals were poor risks. There are logical reasons for this. Exchange enrollees in the first year of operation were far less healthy than average. Some individuals were previously uninsured, while others switched from more costly risk-rated health plans. Healthy individuals were allowed to keep their pre-ACA (risk-rated) plans through 2014, and in Iowafs case, until 2016. Thus, individuals paying higher premiums — reflecting poor health status — were most likely to seek coverage in the exchange.

COOPsf capital was initially made up of funds borrowed from the federal government. Health COOPs borrowed more than $75 million in startup funds that must be repaid within 5 years.9 In additions, more than $2 billion in low-interest solvency loans are to be repaid within 15 years.

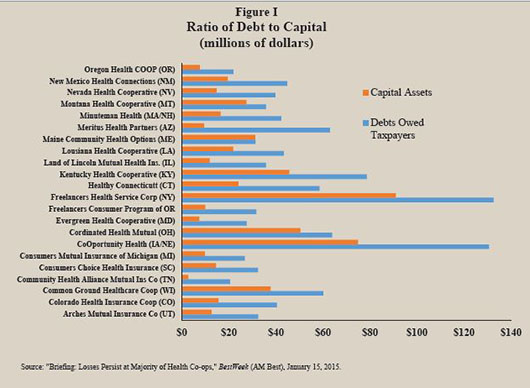

One measure of a COOPfs financial health is the insurersf capital & surplus — that is, the amount of capital minus liabilities. The higher the ratio of debts to capital, the greater the likelihood taxpayers will lose their investment. This is because COOPs with a high debt ratio will have to repay taxpayers out of accumulated profits — which virtually none of the COOPs have earned. As Figure I illustrates, with the exception of Maine Community Health Options, all COOPs have debts far in excess of their capital.

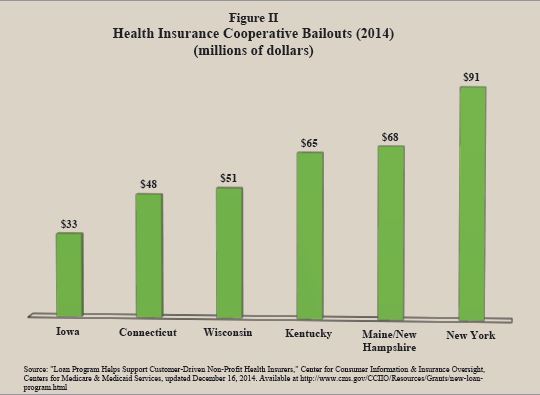

Surviving on Borrowed Money and Begging for More. By September 2014, many of the COOPs were hemorrhaging cash and needed emergency solvency loans. In the last four months of 2014, the U.S. Department of Health and Human Services (HHS) provided six state COOPs with $355 million in emergency solvency funding [see Figure II]: 10

- State COOPs receiving emergency funding included Connecticut ($48.4 million), Iowa ($32.7 million), Maine/New Hampshire ($67.6 million) and New York ($90.7 million).

- CoOportunity received $33 million from HHS in September 2014 — only to return three months later asking for another bailout.

- HHS denied CoOportunity Healthfs second request, but it did provide two other struggling health insurance cooperatives with emergency solvency loans.11

- Wisconsin-based Common Ground Healthcare Cooperative received nearly $23 million more in emergency funds in December after accepting more than $28 million three months earlier.

- The Kentucky Health Cooperative received a $65 million emergency solvency loan only days prior to the second open enrollment period for the health insurance exchange in November 10, 2014.

History of Losses. According to industry data, only one of the 23 COOPs was profitable last year, and a 24th COOP located in Vermont failed before it even got off the ground.12 The COOP in Vermont was poorly implemented and did not have adequate resources to qualify for a license to sell policies in Vermont.13

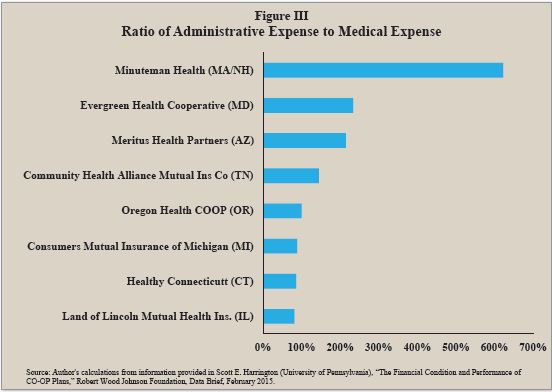

Some COOPs are close to breaking even, while others are losing money on multiple fronts. According to third quarter data, more than one-third of COOPs had medical claims that exceeded premiums. Administrative expenses and claims adjustment expenses added to these losses. A common complaint about private health insurers is their administrative expenses are higher than public programs like Medicare and Medicaid. Many proponents hoped the cooperatives operating in the exchange system would be able to lower administrative expenses. ACA regulations cap administrative expenses at no more than 15 percent to 20 percent of premiums, anticipating medical claims would constitute the other 80 percent to 85 percent. Yet, more than one-third of the COOPs had general expenses that either about equaled or exceeded medical claims expenses — some by a huge margin.14 [See Figure III.]

In total, 23 COOPs lost $244 million through the first three quarters of 2014, their first year of operation.15 For every $100 in premiums, the COOPs spent about $117, on average.16 While some of the COOPs are losing money because of their small size, others appear to have pursued the strategy of losing money to gain market-share at taxpayersf expense.17

Case Study: CoOportunity Health. Consider the example of health insurer, CoOportunity Health, which was taken over in December 2014 by Iowa insurance regulators.18 The cooperative sold policies in both Iowa and Nebraska, and accounted for one-fifth of all COOP enrollees nationally. Iowa and Nebraskafs Guarantee Associations — and state and federal taxpayers — are liable for millions in claims from health care providers the COOP could not pay. State guarantee associations are designed to protect state policyholders in the event their insurer becomes insolvent. Guarantee associations are usually funded by taxes or assessments on all insurers within a state. This is the first failure, but will undoubtedly not be the last.

CoOportunity Health failed less than a year after it began offering coverage to the public. It defaulted on $145 million in taxpayer loans and owes enormous sums to doctors and hospitals. Prior to its first open enrollment, chief operating officer (COO) Cliff Gold told the Lincoln, Nebraska, Journal Star that gCoOportunity would be a market disruptor,h and gwefre nonprofit, we have absolutely no profit motive.h19 Apparently Gold meant his comments to be taken literally: CoOportunity lost around $163 million in 2014 — its first year selling health insurance. An attorney hired to help liquidate the firm says doctors and hospitals are still owed some $100 million. Due to its low premiums, large network and rich benefit package, CoOportunity Health quickly enrolled nearly 10 times its projected first-year enrollment — swelling to nearly 115,000 people at one point. CoOportunity could have made the prudent decision to charge actuarially sound premiums and to grow conservatively, considering its lack of reserves and the risks involved. Instead, top executives pursued the risky strategy of a market disruptor, selling comprehensive coverage well below its cost — and saddling taxpayers with its losses.

In what is called adverse selection in insurance, sicker-than-average Iowa and Nebraska residents flocked to CoOportunityfs generous offerings: large provider networks and rich benefit packages.20 Its premiums were also lower than most of its competitors.21 This approach was attractive to Iowa or Nebraska residents with chronic conditions. But it is not so good for taxpayers who must pay for the losses. CoOportunity didnft just suffer adverse selection, it played a game of chicken with other insurers when it purposely designed plans and set premiums it knew would disrupt the market. Indeed, the Wall Street Journal referred to it as Fannie Med, in reference to Fannie Mae, the infamous government-supported mortgage insurer whose risky investment strategy contributed to the 2008 financial crisis that devastated the U.S. economy.22

CoOportunity executives undoubtedly expected significant first-year loses. Top management included a former insurance commissioner and a BlueCross executive.23 Indeed, more established insurers suspected exchange plan enrollees would be expensive to insure in the first year of operation, and many insurers decided against selling exchange plans in 2014.

Unfortunately, even nonprofit health insurers must earn a profit to avoid bankruptcy. The Iowa insurance commissioner shuttered the failing company once it became clear CoOportunity would not receive another government emergency solvency loan and its anticipated $126 million bailout would be reduced by about half.24

What level of premium should CoOportunity have charged enrollees? A back-of-the-envelope calculation suggests the firm should have billed each member an additional $100 per month, whereas its losses averaged $1,417 per member.25 Of course, had the firm charged more, it could not have grown as quickly. Indeed, if a company is losing money on every customer, it cannot make up for its losses by increasing its volume of sales.

Hoping for a Taxpayer Bailout. Congress established three risk-spreading provisions in the ACA for insurers who experience adverse selection. One is a temporary risk-spreading program, made up of funds collected from fees and taxes on all insurers, to cover industry losses.In late 2014, CoOportunity expected the U.S. Department of Health & Human Services (HHS) to divvy up some of the ACAfs risk adjustment funds, including some $126 million in risk corridor funds. However, the omnibus spending bill passed in December 2014 limited the risk corridor funds HHS may distribute. In addition, Congress slashed funding for the COOP program by two-thirds over the past several years to reduce taxpayersf losses — from $6 billion down to $2 billion. By December 2014, HHS had spent all its money dedicated to emergency solvency loans. When it became clear that only about half of the $126 million CoOportunity expected to cover its losses would be forthcoming, state regulators had to shut down the defunct insurer.

Taken together, these facts suggest CoOportunity executives purposely set rates low to gain market share — assuming taxpayers would bail out their losses. The strategic plan was simple: 1) underprice premiums to gain market share; 2) let taxpayers bail out the losses with emergency solvency loans and risk-adjustment distributions; 3) increase premiums after the dust settled. This type of activity should not have been allowed, but it appears to be a common strategy among health insurance COOPs. Most stakeholders — apparently including CoOportunity Health — expected taxpayers to bailout struggling COOPs indefinitely. It is now clear that bailout is not forthcoming.

Conclusion. The spectacular failure of CoOportunity Health was a wakeup call to other health insurance cooperatives, state insurance commissioners, the U.S. Department of Health & Human Services, Congress and taxpayers. But it wonft be the last COOP that goes broke, owing taxpayers large sums of money.

Going forward, state insurance regulators and other government regulatory bodies need to be on the lookout for COOPs that employ strategic plans premised on losing money while gaining market share — expecting taxpayers to bail them out. This strategy will likely play out again and again until most of the COOP health insurers lose all their taxpayer financing and go bankrupt.

Devon M. Herrick is a senior fellow with the National Center for Policy Analysis.

Notes

- Devon M. Herrick, gConsumer Oriented and Operated Plans: An Idea whose Purpose has Come and Gone,h Statement before the Committee on Oversight & Government Reform Subcommittee on Energy Policy, Health Care and Entitlements and the Subcommittee on Economic Growth, Job Creation and Regulatory Affairs, hearing on gHealth, Health Insurance CO-OPs: Examining ObamaCarefs $2 Billion Loan Gamble,h February 5, 2014.

- James T. OfConnor, gComprehending the compromise: Key Considerations in Understanding the CO-OP as an Alternative to the Public Plan,h Milliman, Inc., June 26 2009; available at http://www.milliman.com/insight/healthreform/Comprehending-the-compromise-Key-considerations-in-understanding-the-co-op-as-an-alternative-to-the-public-plan/; and Julia James et al., eHealth Policy Brief: The CO-OP Health Insurance Program,f Health Affairs, updated January 23, 2014, available at http://www.healthaffairs.org/healthpolicybriefs/brief.php?brief_id=107.

- Department of Health and Human Services, 45 CFR Part 156 [CMS–9983–F] RIN 0938–AQ98, gPatient Protection and Affordable Care Act; Establishment of Consumer Operated and Oriented Plan (CO–OP) Program,h Federal Register, Vol. 76, No. 239, December 13, 2011, pages 77,392 – 77,415. Available at http://www.gpo.gov/fdsys/pkg/FR-2011-12-13/pdf/2011-31864.pdf.

- Tim Worstall, gCoOportunity Health Isnft an Obamacare Problem, Itfs a Cooperative Problem,h Forbes, December 29, 2014. Available at http://www.forbes.com/sites/timworstall/2014/12/29/cooportinuty-health-isnt-an-obamacare-problem-its-a-cooperative-problem/.

- Jerry Markon, gHealth Co-Ops, Created to Foster Competition and Lower Insurance Costs, Are In Danger,h Washington Post, October 22, 2013. Available at http://www.washingtonpost.com/politics/health-co-ops-created-to-foster-competition-and-lower-insurance-costs-are-facing-danger/2013/10/22/e1c961fe-3809-11e3-ae46-e4248e75c8ea_story.html.

- Paul Krugman, gObamafs Trust Problem,h New York Times, August 20, 2009. Available at: http://www.nytimes.com/2009/08/21/opinion/21krugman.html.

- gRockefeller Decimates Co-ops in Letter to Baucus and Grassley,h Daily Kos, September 16, 2009. Available at http://www.dailykos.com/story/2009/09/16/782985/-Rockefeller-Decimates-Co-ops-in-Letter-to-Baucus-and-Grassley.

- See gBriefing: Losses Persist at Majority of Health Co-ops,h BestWeek (AM Best), January 15, 2015. Available at http://www3.ambest.com/bestweek/purchase.asp?record_code=232698&URATINGID=2625286&altsrc=0&fs=0&altnum=0&b=0&tl=7&c=N.

- Scott E. Harrington (University of Pennsylvania), gThe Financial Condition and Performance of CO-OP Plans,h Robert Wood Johnson Foundation, Data Brief, February 2015, page 2.

- gLoan Program Helps Support Customer-Driven Non-Profit Health Insurers,h Center for Consumer Information & Insurance Oversight, Centers for Medicare & Medicaid Services, updated December 16, 2014. Available at http://www.cms.gov/CCIIO/Resources/Grants/new-loan-program.html

- Paul Demko, gCo-op Insurers Receive Additional Federal Loan Dollars to Boost Solvency,h Modern Healthcare, December 23, 2014. Available at http://www.modernhealthcare.com/article/20141223/NEWS/312239973.

- Data through the third quarter, 2014. See gBriefing: Losses Persist at Majority of Health Co-ops,h BestWeek (AM Best), January 15, 2015. Available at http://www3.ambest.com/bestweek/purchase.asp?record_code=232698&URATINGID=2625286&altsrc=0&fs=0&altnum=0&b=0&tl=7&c=N.

- Richard Pollock, gVermont Insurance Regulator Delivers Setback to Obamacare CO-OP,h Washington Examiner, May 30, 2013. Also see Dale Schaft (Information Management Officer), gVermont Health CO-OP Fails State Insurance Standards,h Vermont Department of Financial Regulation, May 22, 2013.

- Scott E. Harrington (University of Pennsylvania), gThe Financial Condition and Performance of CO-OP Plans,h Robert Wood Johnson Foundation, Data Brief, February 2015, page 6.

- Dan Mangan, gObamacare CO-OPs Try to Swim—Not Sink—as Red Ink Persists,h CNBC.com, January 26, 2015. Available at http://www.cnbc.com/id/102364418. See also gBriefing: Losses Persist at Majority of Health Co-ops,h BestWeek (AM Best), January 15, 2015.

- Scott E. Harrington (University of Pennsylvania), gThe Financial Condition and Performance of CO-OP Plans,h Robert Wood Johnson Foundation, Data Brief, February 2015, page 6.

- gFannie Med Implodes: An ObamaCare-funded Insurer in Iowa is Sent to the Morgue,h Wall Street Journal, December 28, 2014. Available at http://www.wsj.com/articles/fannie-med-implodes-1419812352.

- Anna Wilde Mathews, gState Regulator to Shut Down Insurer CoOportunity Health,h Wall Street Journal, January 23, 2015. Available at http://www.wsj.com/articles/state-regulator-to-shut-down-insurer-cooportunity-health-1422052829.

- Richard Piersol, gNonprofit Health Insurer Intends to be Market eDisruptor,fh Lincoln Journal Star, March 30, 2013. Available at http://journalstar.com/business/local/nonprofit-health-insurer-intends-to-be-market-disruptor/article_b28c3da1-d9aa-5d55-8787-5593d8229300.html.

- Trudy Lieferman, gWhy Did CoOportunity fail? The insurance CO-OPfs Struggles Raise Questions about the Efforts to Foster Competition,h Columbia Journalism Review, January 19, 2015. Available at http://www.cjr.org/united_states_project/why_did_cooportunity_fail.php.

- Steve Jordon, gInsurance Agents Stung by CoOportunity Healthfs Collapse,h World-Herald, January 9, 2015. Available at http://www.livewellnebraska.com/consumer/insurance-agents-stung-by-cooportunity-health-s-collapse/article_17362220-7df5-5ff7-ba5b-3d05ddbfbbd3.html.

- gFannie Med Implodes: An ObamaCare-funded Insurer in Iowa Is Sent to the Morgue,h Wall Street Journal, December 28, 2014. Available at http://www.wsj.com/articles/fannie-med-implodes-1419812352.

- Tony Leys, gCoOportunity Health Falters, Taken Over by State,h Des Moines Register, December 30, 2014. Available at http://www.desmoinesregister.com/story/news/2014/12/24/cooportunity-health-taken-iowa-insurance-division/20856151/.

- Anna Wilde Mathews, gState Regulator to Shut Down Insurer CoOportunity Health,h Wall Street Journal, January 23, 2015. Available at http://www.wsj.com/articles/state-regulator-to-shut-down-insurer-cooportunity-health-1422052829.

- For example, a loss of $163,000,000 in 2014 divided by approximately 115,000 members equals a loss of about $1,417 per member enrolled.